- News

- Business News

- International Business News

- Is a US recession coming? 5 key questions answered

Trending

Is a US recession coming? 5 key questions answered

The US economy may be heading into rough weather — and when America slows down, the world feels the tremors. With Trump tariffs putting global trade under pressure and India closely tied to both the US and China, a possible recession in the US can, at the very least, slow down growth rate in India too.Here's what economists and investors are saying:

5 key questions answered

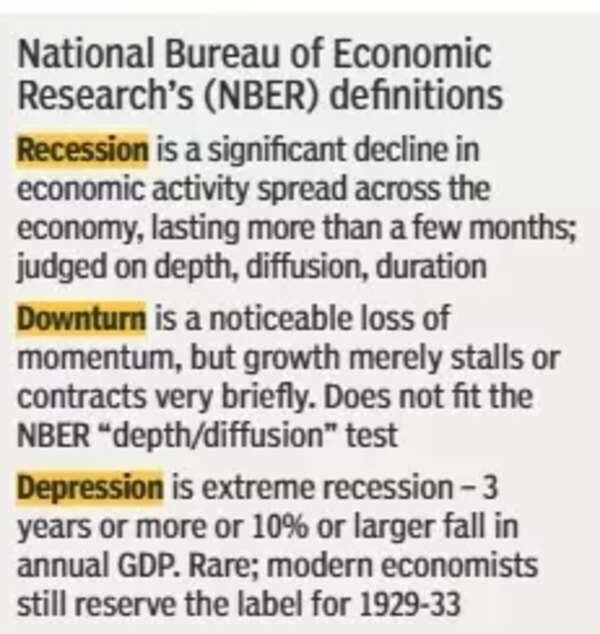

1. How close is US to a recession?

Five agencies and experts have following to say:

| Agency | Key Reasons |

|---|---|

| Conference Board’s Leading Economic Index (LEI) has declined at least 15 of the past 18 months; board says a “significant growth slowdown” is baked in, though a full recession is still not its base case | Weakness across manufacturing new orders, consumer expectations, and building permits |

| Reuters economists’ poll of April 7 puts median probability of recession in next 12 months at 45% – highest since Dec 2023 | Tariffs already shaving 0.8 percentage point off 2025 GDP forecasts; business sentiment and capex plans falling |

| Moody’s Analytics’ Mark Zandi in a March 2025 podcast put recession odds at 40% by end-2025 | Tariffs, fading fiscal impulse, and tight credit standards |

| Bloomberg Opinion’s John Authers says odds of a 2008-style policy mistake are rising; warns “it’s best not to wait for NBER confirmation” | 15-month slide in the Conference Board Leading Economic Index, tariff shock to supply chains, and a deeply inverted 2-10 year Treasury curve |

| Ray Dalio, founder Bridgewater Associates, has said the US is “very close to a recession,” adding that tariffs are “like throwing rocks into the production system” and could lead to “something worse than a recession” if mishandled | Tariff shock is crippling supply-chain efficiency; combines with ballooning US debt, a “breakdown of the monetary order,” and intensifying geopolitical conflict — conditions, Dalio says, mirror the 1930s |

2. US recessions since 2000

| Recession | Peak | Trough | Duration (months) | Real GDP peak-to-trough | Peak Unemployment |

|---|---|---|---|---|---|

| Dot-com / 9-11 | Mar 2001 | Nov 2001 | 8 | –0.3% | 5.7% |

| Great Recession | Dec 2007 | Jun 2009 | 18 | –4.0% | 10.0% |

| Covid-19 Recession | Feb 2020 | Apr 2020 | 2 (shortest on record) | –19.2% (q/q annualized Q2) | 14.7% |

3. Can US recession trigger global recessions?

US recessions can go global when they coincide with a systemic financial shock (2008) or an exogenous event (pandemic). Otherwise, spill-overs are milder. IMF has ruled out a global recession.

- 2001 US recession did not cause a global one. World GDP grew 2.5%, but trade growth collapsed.

- 2007–09 was a US & global recession — first post-war global contraction (~1.3% world GDP '09)

- 2020 Covid lockdown pushed world GDP down by ~3%, deepest since 1945

4. China & India recessions since 2000

Periods of outright GDP contraction (past 25 years)

- Q1 2020 (–6.8% y/y) – first contraction since 1976

Notes: Annual growth still +2.2% for 2020; 2022 growth just 3% (worst outside 2020)

- FY 2020-21 (–7.3%, with –24% in April–June 2020); RBI classified H1 FY21 as a “technical recession”

- 1991 balance-of-payments crisis (real GDP +1%)

- 2008-09 slowdown (growth fell to 3.1%, but stayed positive)

5. Why a recession in India is different from one in the US

| Dimension | United States | India |

|---|---|---|

| General nature of primary shock | Financial cycle & consumer credit (housing, credit cards); inventory cycle | Supply-side shocks (oil, monsoon), external capital flows, informal-sector demand |

| Stabilising factors | Large: Unemployment insurance, progressive taxes mitigate hit | Small; Informal employment > 45% limits social-security reach |

| Monetary-policy pass-through | Fast: Deep bond market, mortgage refinance | Slower; Bank-led system, high share of small firms outside formal credit |

| Job & Wages | Unemployment rises sharply but benefits cushion income | Job losses push workers back into agriculture/informality, depressing under-employment more than jobless rate |

| Global spillover | A US recession tightens global financial conditions via dollar funding & risk aversion | An Indian recession mainly drags on regional trade, remittances, and commodity demand; financial contagion limited by capital controls |

Stay informed with the latest business news, updates on bank holidays and public holidays.

Master Value & Valuation with ET! Learn to invest smartly & decode financials. Limited seats at 33% off – Enroll now!

End of Article

Follow Us On Social Media