- News

- Business News

- India Business News

- India Business News

- Gold vs Nifty 50: Yellow metal emerges as best performing asset in FY25, but Indian equities outperform in long-term

Trending

Gold vs Nifty 50: Yellow metal emerges as best performing asset in FY25, but Indian equities outperform in long-term

Gold surged in FY25, gaining 41% in USD and 33% in rupee terms, driven by its safe-haven status and central bank buying. Despite this, Indian equities outperformed gold over longer periods.

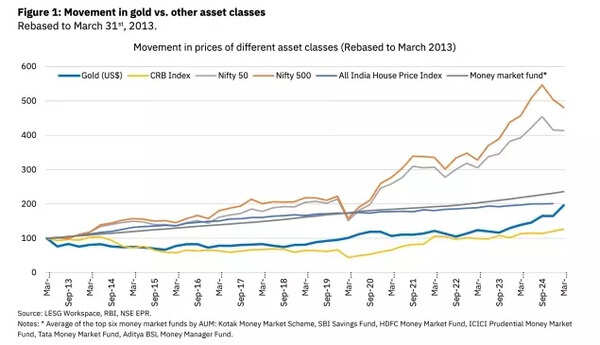

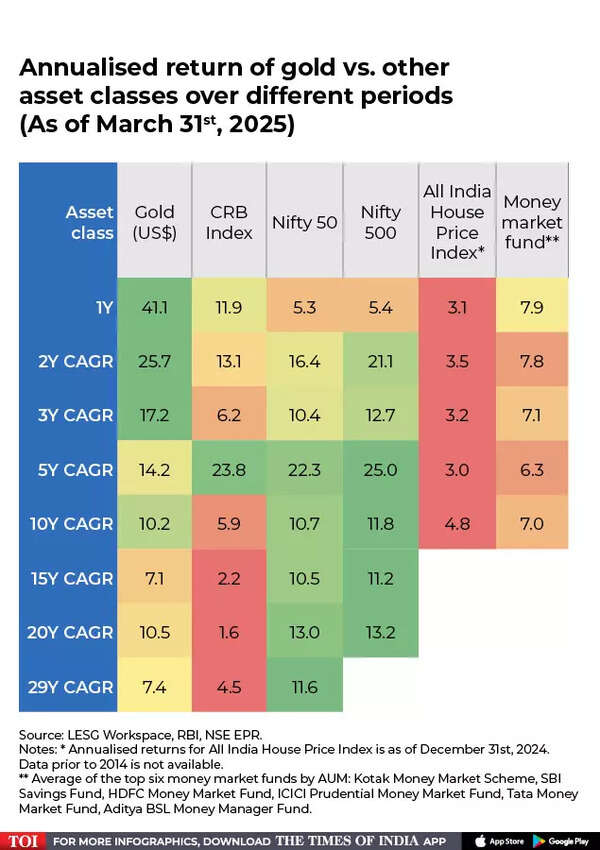

Gold, traditionally a safe have investment, was the best-performing asset class in financial year 2024-25, according to the latest edition of NSE's 'Market Pulse' report. Gold recorded a 41% gain in USD terms and 33% in rupee terms, reaching unprecedented levels exceeding US$3,125/oz (Rs 88,946 per 10 grams).This is mainly because of its status as a secure investment during times of global instability. Gold price increase has been supported by central bank acquisitions in recent years. Nevertheless,Indian equities have shown better performance over extended periods, However, it’s important to note that Indian equities have yielded superior returns, on a longer term horizon. The Nifty 50 has achieved a 13% yearly price increase and a 14.4% total return (inclusive of dividends) across 20 years, surpassing gold's performance during comparable timeframes, according to NSE’s April edition of ‘Market Pulse’ report.Gold demand reached its highest level in 15 years, driven by substantial investment flows and persistent central bank acquisitions—more than 1,000 tonnes for the third consecutive year—as part of a broader strategy to diversify reserves.

Gold vs other asset classes

Annualised return of gold vs other asset classes

Stay informed with the latest business news, updates on bank holidays and public holidays.

AI Masterclass for Students. Upskill Young Ones Today!– Join Now

End of Article

Follow Us On Social Media