- News

- Business News

- India Business News

- India Business News

- Sensex soars 1,200 points on Trump’s ‘zero tariff’ note

Trending

Sensex soars 1,200 points on Trump’s ‘zero tariff’ note

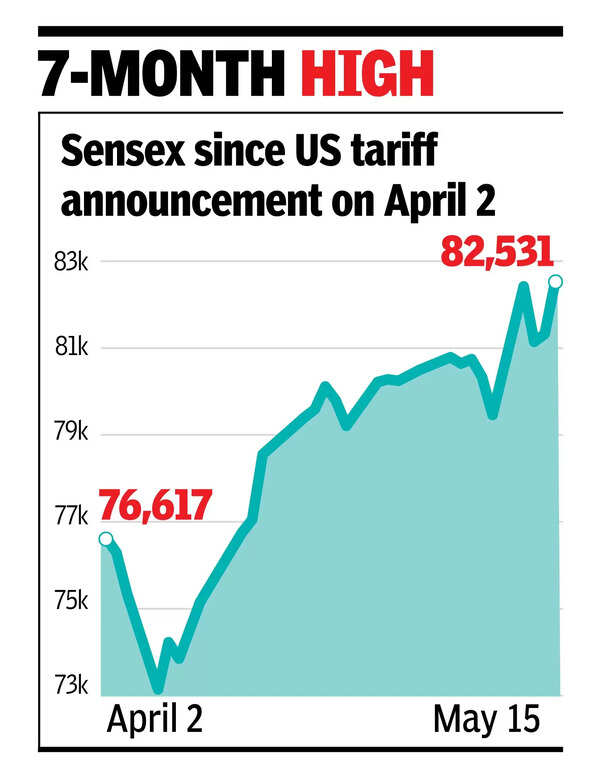

Market sentiment surged following positive news, including US President Trump's hint at a potential zero-tariff deal with India and encouraging domestic inflation figures. This led to a significant rally on Dalal Street, with both the Sensex and Nifty reaching seven-month closing highs. Foreign funds fueled the surge, while investors saw a substantial increase in wealth.

MUMBAI: US President Donald Trump’s statement about the possibility of a zero-tariff deal with India during his West Asia tour boosted market sentiment on Thursday.This helped Nifty close above the 25,000 level. The southward movement of domestic inflation numbers, which could help RBI cut interest rates in June, also helped sentiment on Dalal Street, market players said.After opening flat and dipping into negative territory, the sensex rallied from mid-session to close 1,200 points (1.5%) up at 82,531 points. Treading a similar path, Nifty closed 395 points (1.6%) higher at 25,062 points. Both indices are at their respective seven-month closing high levels.

7-month high

Stay informed with the latest business news, updates on bank holidays and public holidays.

AI Masterclass for Students. Upskill Young Ones Today!– Join Now

End of Article

Follow Us On Social Media